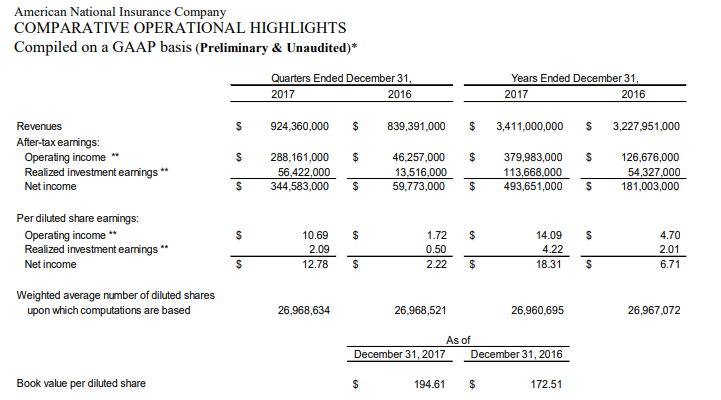

GALVESTON, TX — American National Insurance Company (Nasdaq: ANAT) announced fourth quarter net income of $344.6 million or $12.78 per diluted share, a $284.8 million increase from net income for the same period of 2016 of $59.8 million or $2.22 per diluted share. The increase in fourth quarter net income includes a provisional $206.4 million benefit resulting from the recently enacted U.S. Tax Cut and Jobs Act (“Tax Reform”). This impact from Tax Reform is currently an estimate and may be adjusted, possibly materially, due to additional calculations and/or further tax guidance. Excluding the impact from Tax Reform, net income for the fourth quarter was $138.2 million, an increase of $78.4 million from the same period of 2016. Book value per diluted share increased to $194.61 at December 31, 2017 from $172.51 at December 31, 2016.

Excluding the impact of Tax Reform, fourth quarter after-tax operating income, which excludes realized investment earnings, increased to $81.8 million or $3.03 per diluted share compared to $46.3 million or $1.72 per diluted share for the same period of 2016. Including the impact of Tax Reform, fourth quarter after-tax operating income was $288.2 million or $10.69 per diluted share. Earnings from Life and Property and Casualty segments increased significantly compared to the same period of 2016.

After-tax realized investment earnings for the fourth quarter of 2017 increased to $56.4 million or $2.09 per diluted share compared to $13.5 million or $0.50 per diluted share for the same period in 2016 due to sales of equity securities and certain real estate holdings in favorable market conditions. Realized investment earnings are comprised of realized investment gains, equity in earnings of unconsolidated affiliates and income (loss) from non-controlling interests.

Net income for the year ended December 31, 2017 was $493.7 million, a $312.7 million increase from $181.0 million for 2016. Aside from the estimated $206.4 million benefit resulting from Tax Reform, income for 2017 benefitted from increased earnings in all insurance segments.

Excluding the impact of Tax Reform, after-tax operating income for 2017, which excludes realized investment earnings, was $173.6 million or $6.43 per diluted share, an increase of $46.9 million from $126.7 million or $4.70 per diluted share from 2016. Including the impact of Tax Reform, after-tax operating income for 2017 was $380.0 million or $14.09 per diluted share.

After-tax realized investment earnings for 2017 were $113.7 million or $4.22 per diluted share compared to $54.3 million or $2.01 per diluted share for 2016, primarily due to increased sales of equity securities and certain real estate holdings. Stockholders’ equity totaled $5.3 billion at December 31, 2017, a 12.8% increase from December 31, 2016.