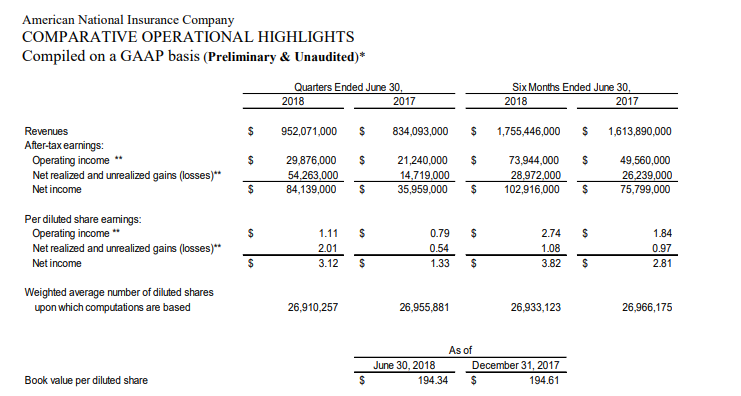

GALVESTON, TX — American National Insurance Company (Nasdaq: ANAT) announced net income of $84.1 million or $3.12 per diluted share for the second quarter of 2018. Net income for the second quarter of 2018 increased by $35.1 million due to the inclusion of unrealized gains on equity securities as a result of new required accounting guidance(1) effective January 1, 2018. Excluding the impact of these unrealized gains, net income increased to $49.0 million or $1.82 per diluted share compared to net income of $35.9 million or $1.33 per diluted share for the second quarter of 2017.

Operating income for the second quarter of 2018 increased to $29.9 million or $1.11 per diluted share compared to $21.2 million or $0.79 per diluted share for the same period of 2017. The increase in operating income for the quarter compared to the same period in 2017 was due primarily to improved performance in our life, annuity and health segments.

Operating income excludes net unrealized gains (losses) on equity securities and realized investment earnings. Realized investment earnings are comprised of realized investment gains (losses), equity in earnings (losses) of unconsolidated affiliates and income (loss) from non-controlling interests. After-tax realized investment earnings for the second quarter of 2018 were $19.1 million or $0.71 per diluted share compared to earnings of $14.7 million or $0.54 per diluted share for the same period in 2017.

Book value per diluted share as of June 30, 2018 was $194.34, compared to book value per share of $194.61 on December 31, 2017. The slight reduction in book value was primarily due to the impact of unrealized losses on bonds and dividends to shareholders which offset increases to book value from net income and the cumulative effect of accounting changes.

Net income for the six months ended June 30, 2018 was $102.9 million. Excluding the impact of $9.4 million in unrealized gains on equity securities resulting from new required accounting guidance(1), net income was $93.5 million compared to $75.8 million for the same period in 2017. Operating earnings through June 2018 increased $24.3 million to $73.9 million from $49.6 million over prior year primarily because of improved results from our life, property and casualty, health and corporate and other segments.